Wolfworks envisions a future in which homes rely on renewably generated electric energy for all occupant uses, including transportation (EV’s), and integrating that system with a backup strategy that relies on battery storage. The Inflation Reduction Act (IRA) is going to accelerate that transition in many practical ways. Buckle up!

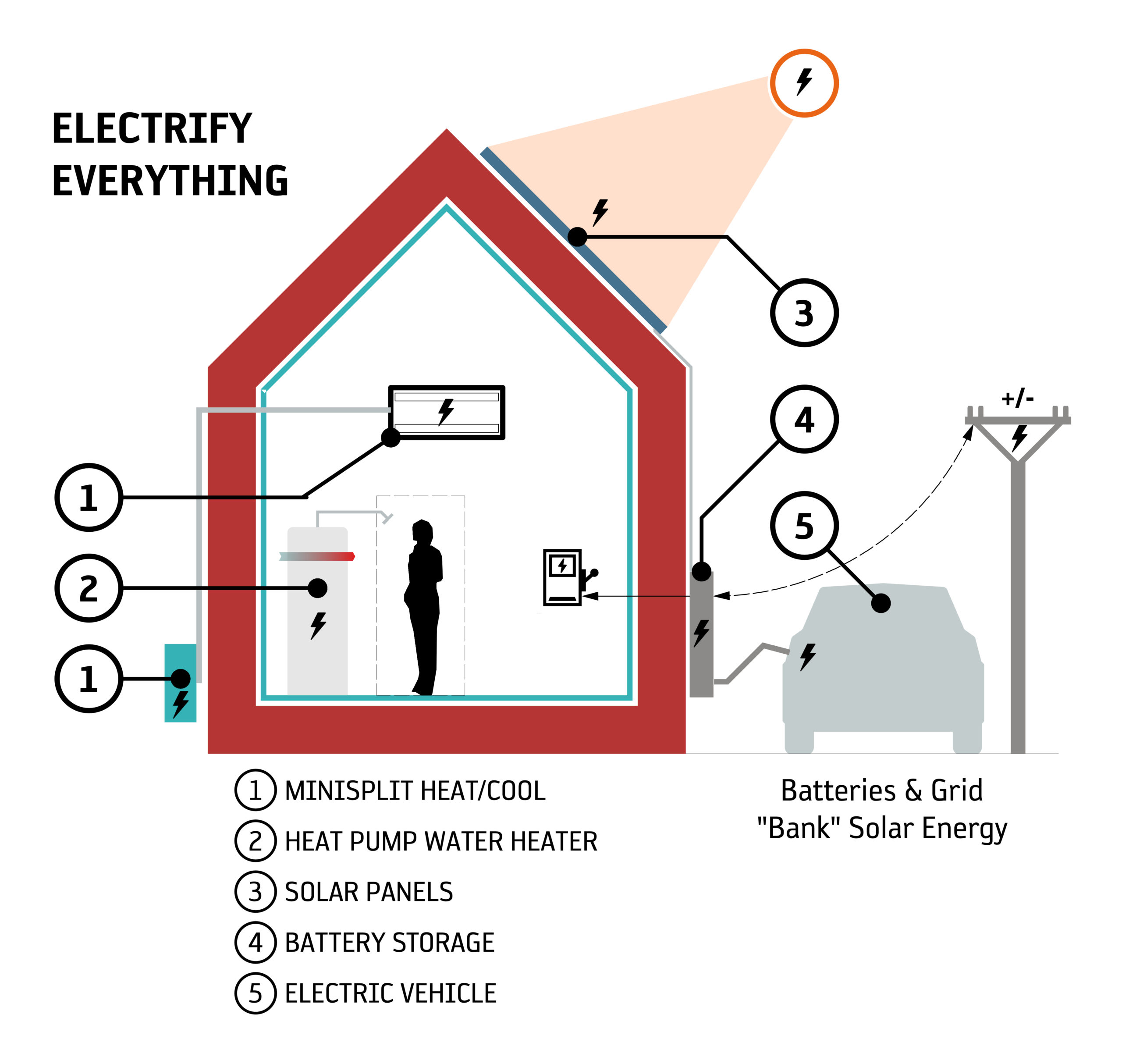

At the heart of this energy transition is the imperative to replace systems that rely on fossil fuels with high efficiency electric alternatives. This movement’s battle cry is “Electrify Everything” and the IRA provides incentives and rebates to replace heating and cooling systems, hot water heaters, and cooking appliances with these proven alternatives. There are also provisions for updating your electrical panel to serve these systems.

Next come the rooftop systems that produce solar energy and store it in batteries to power our electric homes, even during a black out. These systems use smart controls to choose when to recharge those batteries, an electric vehicle if you have one (or are planning to – there are incentives for that too), and how to interact with utility power whether it’s off or on. These systems are all eligible for a 30% tax credit, including the cost of installation.

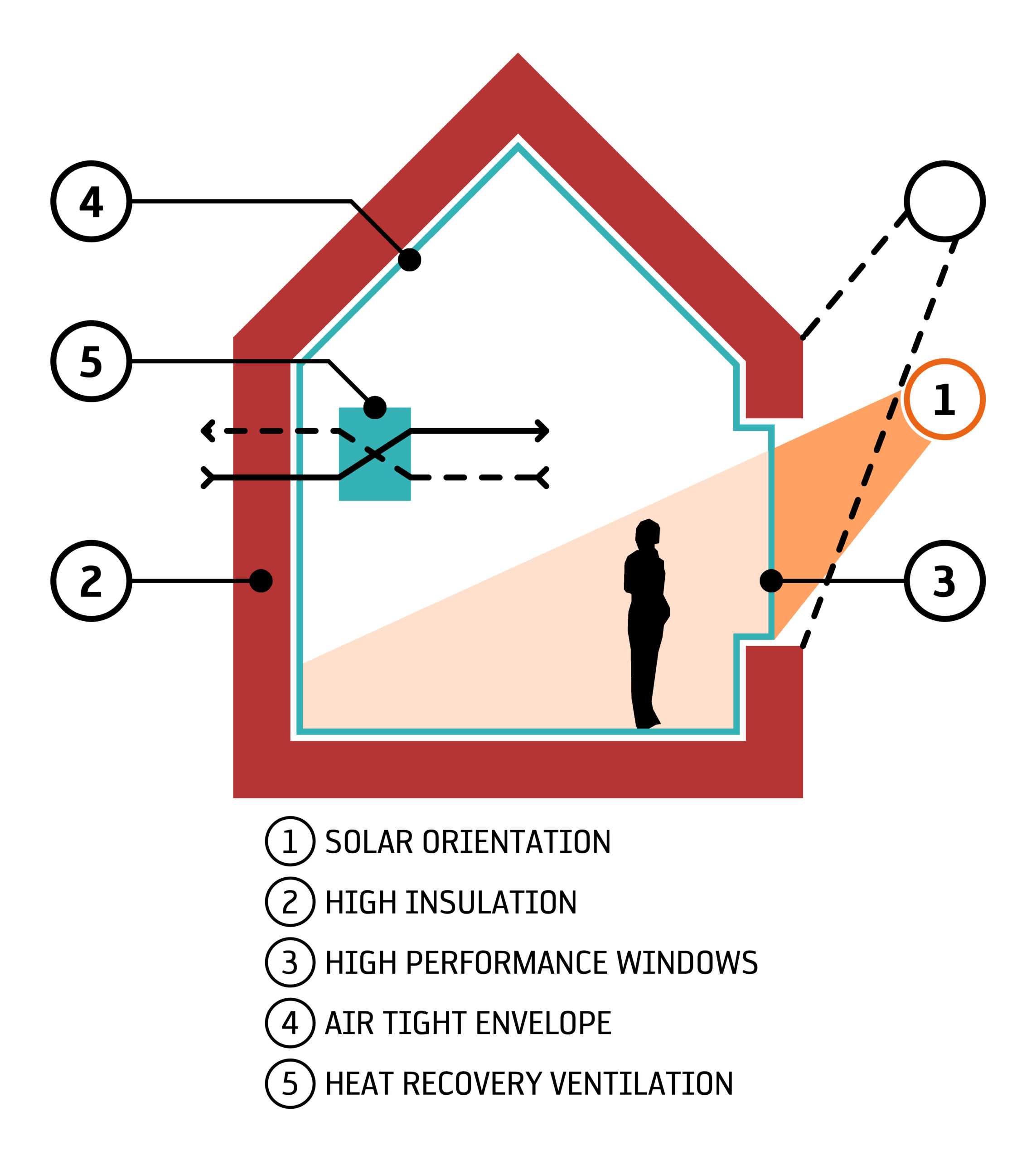

A home that uses less energy to keep comfortable completes the equation. This is the heart of the work we do on every project we touch. There are generous incentives for new and existing homes, including subsidies for energy audits, added insulation and air sealing, and replacement of doors and windows.

Bundling these opportunities aligns with what we preach: Reduce, then Produce. You want to first find ways to require as little precious energy as possible, then meet that need with renewable energy. With the addition of battery, electric vehicle, and utility integration we now amend that to: Reduce, then Produce AND Store.

The challenge that the IRA does not address is how to plan for the integration of these essential activities, then coordinate and manage their execution. As architects and builders working together as one, this is where we live. If you have an interest in taking advantage of some or all of the opportunities the IRA presents, get in touch.

To do a quick calculation of what you may be eligible for, try this Calculator.